Call 08 8100 3355

Call 08 8100 3355

Call 08 8100 3355

Call 08 8100 3355

Seven Steps

Our Process

Our Services

- aged care planning

- investment planning

- superannuation advice

- share trades and advice

- wealth protection

- tax planning

Financial Health Check

Lets get Started!

Become our Client Today

Complete our questionnaire to check your Financial Status and Health

Before we get started we need your permission to gather your data.

Let Accume show you how to reach your financial goals.

The Seven Steps to a Financial Plan

The first step in the process is to get a clear understanding of your assets and liabilities and also your income and expenses. We take the time to investigate your situation in detail so that we can provide you with a full understanding of your existing financial situation.

Every financial plan is different due your individual goals and objectives. Our initial meeting will concentrate on finding out what your unique goals and objectives are which will form the basis for your financial plan.

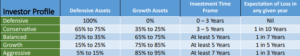

Your risk profile will greatly affect the various strategies that will be appropriate for you. Based on your wishes and our discussions we agree on a level of risk to take with each of your investments and the potential strategies that would be suitable for you. We have five broad categories of investor profiles to be used as a guide in selecting an appropriate asset allocation.

Based on the above research we create a Statement of Advice (financial plan) designed to meet your goals and objectives that is appropriate for you. Usually, a financial plan may incorporate a combination of different strategies.

- Salary packaging,

- Savings plans,

- Investment portfolio,

- Superannuation planning,

- Borrowing to invest,

- Retirement planning,

- Centrelink strategies.

As part of this process we provide comprehensive projections of your financial situation both before and after are recommended strategies are implemented. Just knowing what your financial future will look like if you continue with your current strategy is very empowering.

We discuss the various strategies with you in details so that you can make a confident decision on the best way for you to move forward.

Most people do not achieve financial freedom because they do not have the simple three steps below in place.

- have a long term view,

- have a disciplined approach,

- hold a diversified portfolio spread across various assets

If you can manage this then you will more than likely be doing well in 20 years – we help you to do this

It is important to increase your wealth to enable you to meet your financial goals and objectives, but even more important is to protect you and your family from the financial hardship of disability or death of a family member.

We strongly recommend that you consider insurance to protect you and your family and have your estate planning needs covered.

- Estate planning

- Life Insurance

- Disability Insurance

- Income protection

- Trauma Cover

- Health Insurance

Part of our service is to help you when making a claim as the last thing you need is additional stress of dealing with an insurance company on your own. We have strong relationships with many of Australia’s insurance providers which enables us to make the claims process as smooth as possible.

Not many people enjoy completing paper work – at the implementation stage we complete the majority of the paperwork for you to ensure that your chosen strategy can be implemented in a timely fashion and with the minimum of fuss.

Many factors in your financial situation may change, such as your income, having children, home ownership, interest rates, government legislation and the economic situation. The only way to keep your plan valid and up to date is to regularly re-asses your existing strategy and make any necessary changes to ensure your strategy is still appropriate for you.

To get the full benefit out of your financial strategy and to have full confidence in all the financial decisions you make, you need to build a long term relationship with your adviser. A regular review program can help create this relationship and build trust so you can make financial decisions with confidence when required and in a timely fashion.

The Accume Client Engagement Process

Step 1 - Gathering Data using our Financial Planning Questionnaire

In order to better understand how best we can help you when we first meet, we recommend that you download and fill out our Financial Planning Questionnaire before you meet with us. By having this document filled in and ready will enable us to make the initial appointment as valuable as possible for you.

Step 2 - Book an Appointment & bring your completed Financial Planning Questionnaire

We also recommend that you bring any information on any investments or superannuation products that you currently have, making it easier for us to gather further information if required.

Step 3 - Discovery and Needs Analysis

Discovering your goals and uncovering your investment and financial planning needs occurs during our first meeting. Your goals and objectives form the basis for any advice that we provide to create a tailored financial plan that best suits your needs.

Step 4 - Creation of Financial Plan and issue of Statement of Advice

Based on the information gathered from you and further research on your existing financial position we create a financial plan to meet your goals and objectives. The financial plan is summarised in a written statement of advice which includes our recommendations and the reasons behind these recommendations. We discuss the recommendations with you and then give you time to consider the recommendations, ask questions and make any changes required.

Step 5 - Implementation of your Financial Plan

Once you are completely satisfied with the recommended changes we will assist you in implementing these changes. We take care of any required paperwork to make this process as easy as possible for you. We then monitor the progress of the changes to ensure that they occur in a timely manner.

Step 6 - Revisiting and Reviewing your Financial Plan

We highly recommend that our clients meet with us at least annually to review their financial plan.

Depending on any changes that may have occured since our clients Financial Plan was last implemented, we reformulate and reimplement that previous financial plan to ensure our clients financial goals are more likely to be met. This usually involves repeating steps 1 to 5 above.

Our Services

- Wealth Creation Strategies

- Retirement Planning

- Estate Planning

- Salary Packaging

- Direct Share Portfolios and Transactions

- Tax Minimisation Strategies

- Superannuation

- Life Insurance

- Centrelink Strategies

To take advantage of our service, simply let us know what areas you would like to discuss.

We hope you will take the opportunity to improve your financial position by becoming a client with us or calling us today on 8100 3355.